How to use open interest for intraday trading?

December 4, 2023 by Vishwanath Jadhav

Introduction:

In intraday trading, every piece of information matters. One such powerful tool that can significantly impact trading decisions is open interest. In this article we discuss how to use open interest for intraday trading? Understanding how to leverage open interest effectively can provide traders with valuable insights into market sentiment and potential price movements. In this blog post, we will explore the concept of open interest and delve into the various ways it can be utilized for successful intraday trading strategies. By understanding the open interest my daily profit ratio is increased and I am able to find exact support and resistance levels by studying open interest data. It increased my accuracy to 80%.

Section 1: Discovering Open Interest

The term open interest refers to the total number of outstanding contracts in a particular derivative instrument, such as an option or a futures contract. It represents the number of contracts that are held by market participants but have not been closed or delivered. Unlike volume, which measures the number of contracts traded during a specific period, open interest provides a more holistic view of market activity and participant positions.

Section 2: Interpreting Open Interest

Understanding the significance of open interest requires careful analysis. When open interest increases, it suggests new money flowing into the market, indicating strong participation and potentially signaling the emergence of a new trend. Conversely, a decline in open interest may indicate a decrease in market interest and potentially signify an upcoming trend reversal. By tracking changes in open interest, traders can gauge market sentiment and anticipate possible price movements and capture great moves.

Section 3: Spotting Support and Resistance Levels

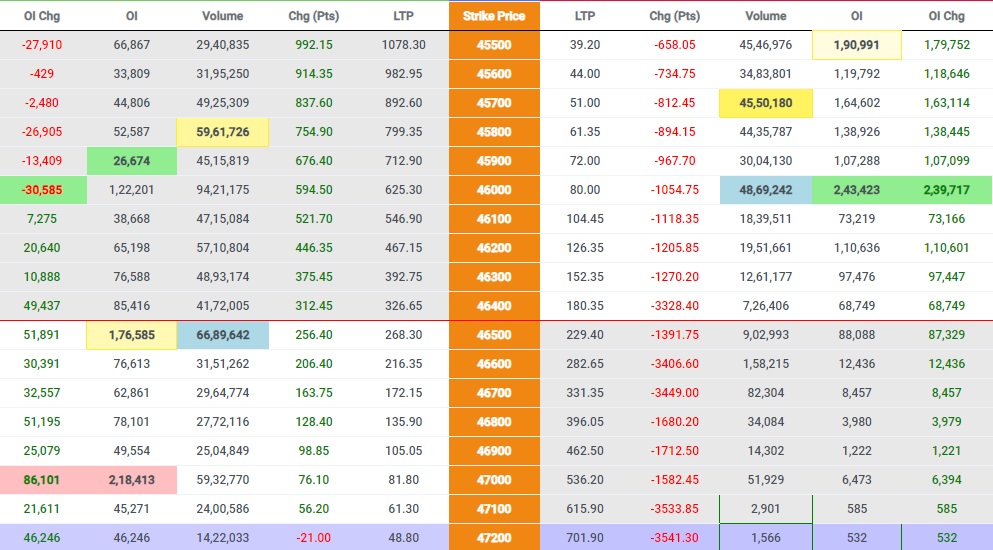

Open interest can be a valuable tool in identifying support and resistance levels for intraday trading. When open interest is high, it indicates a strong level of market interest, which may act as a support or resistance level depending on the direction of the price movement. Traders can observe the relationship between open interest and price action to identify key levels that could influence future price behavior.

Section 4: Analyzing Open Interest Patterns

Examining patterns in open interest can provide traders with additional insights into market dynamics. For example, a rising open interest combined with an increasing price trend may indicate a strong bullish sentiment, suggesting potential buying opportunities. Conversely, a rising open interest alongside a declining price trend could signal a bearish sentiment, prompting traders to consider short-selling strategies.

Section 5: Combining Open Interest with Other Indicators

While open interest can be a powerful tool on its own, I combine it with other technical indicators which enhance trading my strategies. I often use open interest in conjunction with volume analysis, price patterns, and trend indicators to confirm signals and strengthen their decision-making process. By integrating open interest into a comprehensive trading framework, I gain a more comprehensive understanding of market dynamics. I hope you quite understood how to use open interest for intraday trading?

Conclusion:how to use open interest for intraday trading?

Intraday trading requires smart analysis and timely decision-making. Open interest serves as a valuable tool for option traders seeking to gain an edge in the market. By unraveling the mysteries of open interest and employing it effectively, traders can tap into valuable insights, identify support and resistance levels, analyze patterns, and combine it with other indicators for more accurate trading strategies. Embrace the power of open interest and elevate your intraday trading game. Visit www.nseindia.com to get open interest data.